What Does a Financial Goal Plan Look Like?

Each financial goal plan is tailored to a client’s unique goals and needs. The sample slides below show what a plan can look like and how it can bring clarity and confidence to a client’s financial life.

-

![Snapshot Summary Financial Goal Plan]()

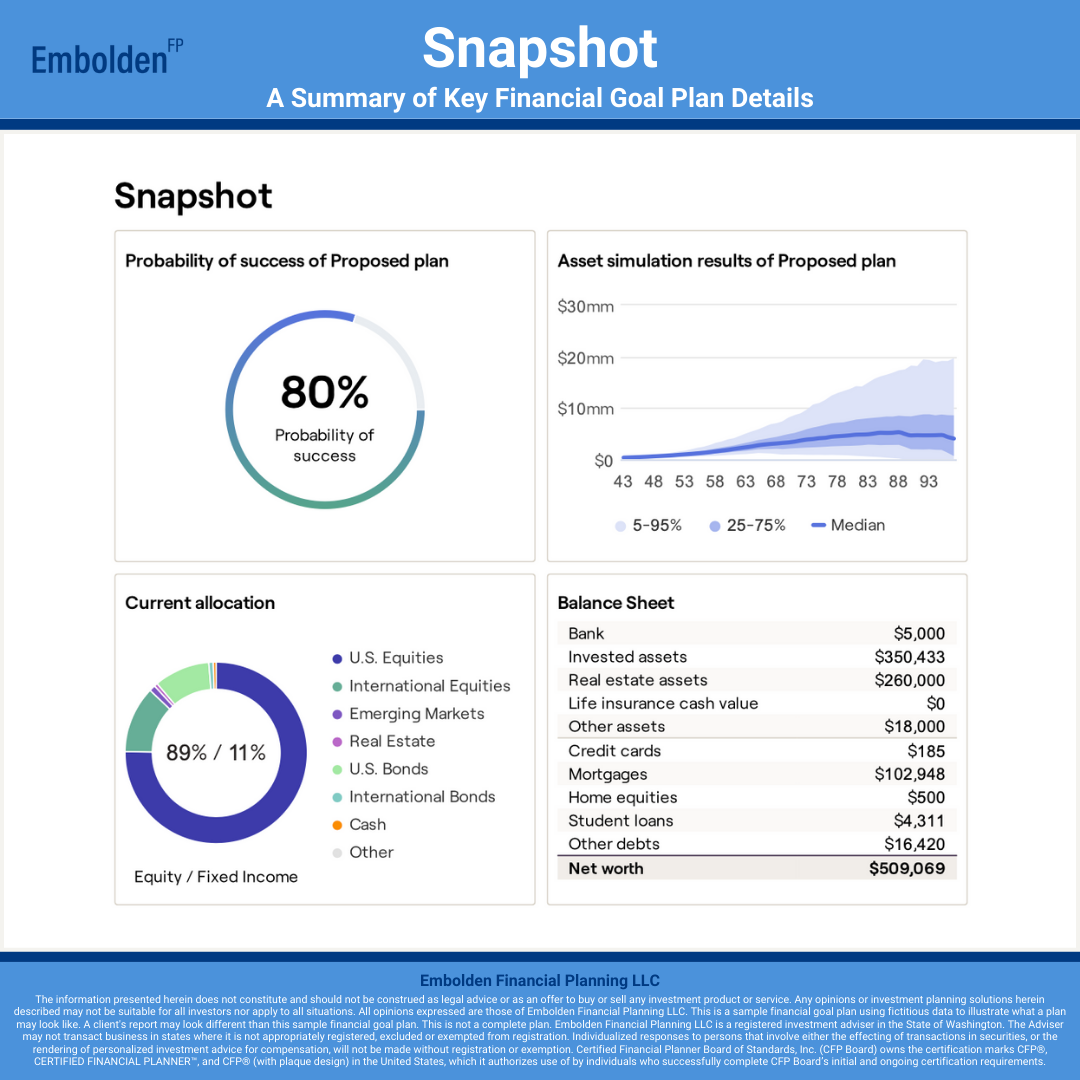

Meet Homer and Marge. This is their financial goal plan.

One of the first pages is the Snapshot, a one-page summary of key elements in their plan. While the detailed information comes later, the Snapshot makes it easy to see the big picture at a glance.

-

![Snapshot Probability of Success Financial Goal Plan]()

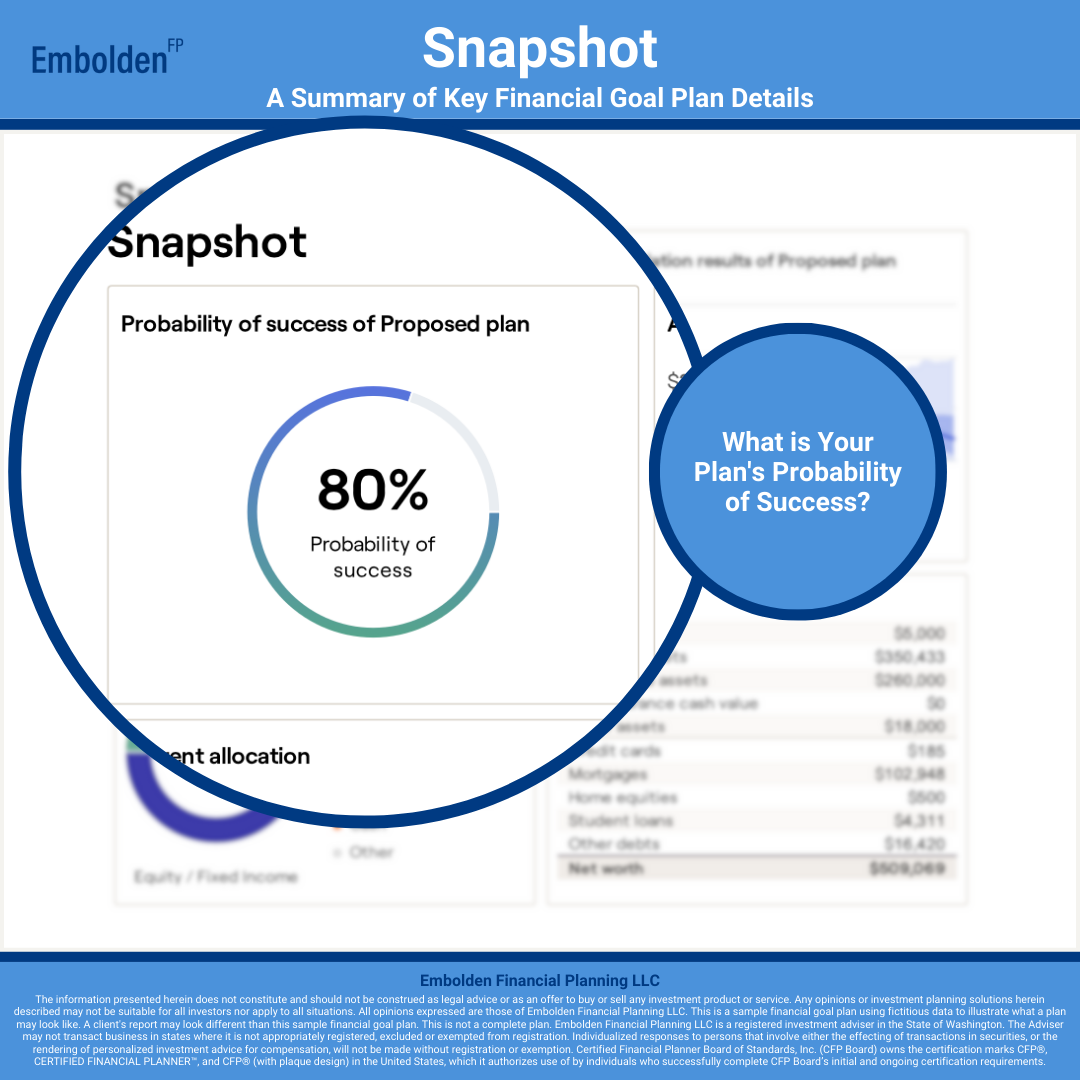

Homer and Marge’s financial goal plan shows an 80% probability of success.

After completing their Discovery, Get Organized, and Explore Possibilities Meetings with Embolden Financial Planning LLC, they now have a clear plan in place. Their plan indicates an 80% likelihood they can achieve their goals before and after retirement without running out of money in any year.

-

![Snapshot Asset Projection Financial Goal Plan]()

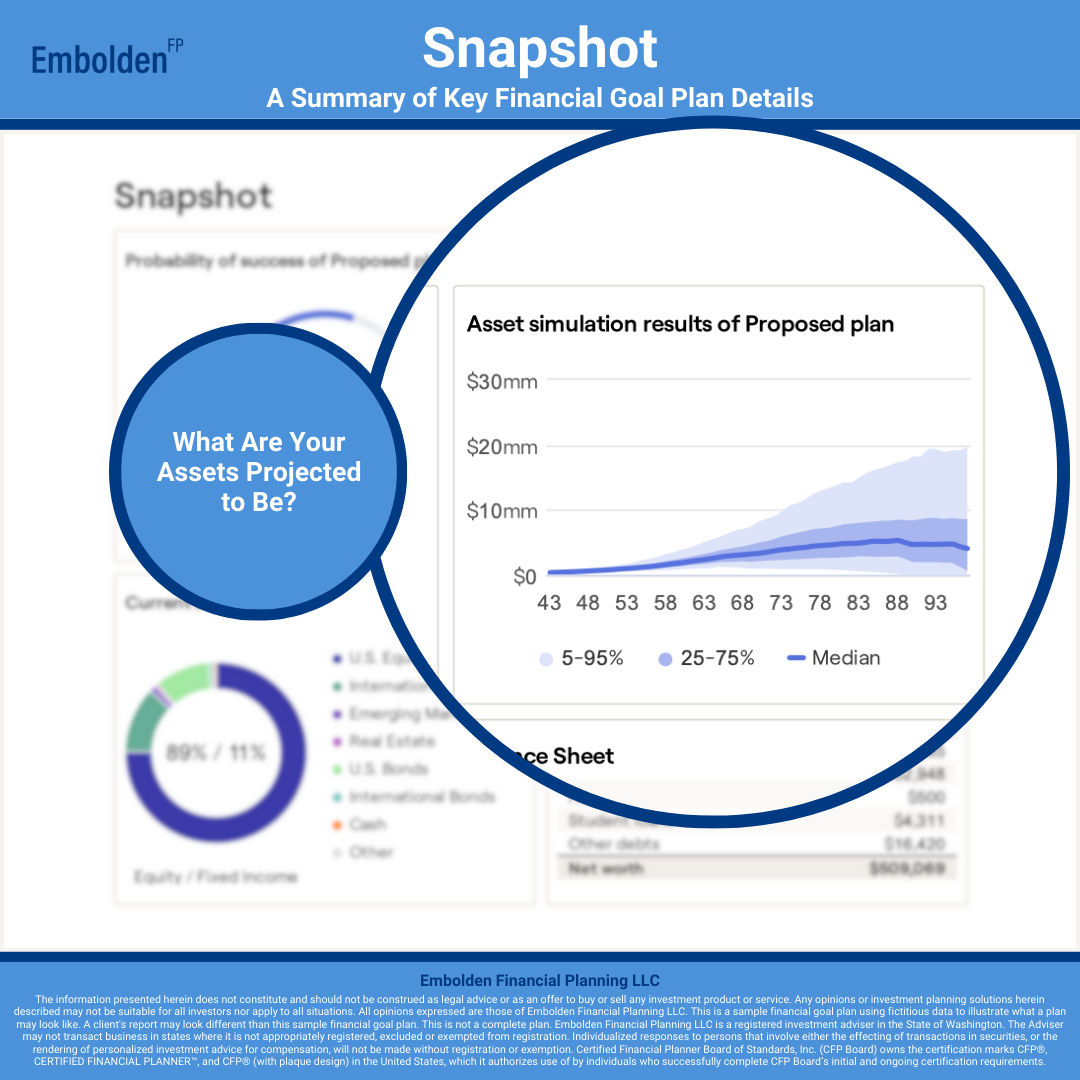

Homer and Marge can see how their investment assets are projected to change over time.

The dark blue line shows the median projection, the midpoint where investment assets may be higher half the time and lower half the time. The shaded areas show the ranges where their investment assets are projected to be about 50% and 90% of the time.

-

![Snapshot Current Allocation Financial Goal Plan]()

Homer and Marge’s investment portfolio is currently 89% stocks and 11% bonds.

Stocks, or equities, typically offer higher return potential but come with more volatility. Bonds, or fixed income, tend to provide stability with lower returns. Their current allocation shows a heavy weighting toward riskier, higher-return investments.

-

![Snapshot Net Worth Financial Goal Plan]()

Homer and Marge can now view their net worth on a personal balance sheet.

By sharing their financial information, including assets and liabilities, and securely linking their accounts in RightCapital, they can see their net worth updated every day.

-

![Balance Sheet Summary Financial Goal Plan]()

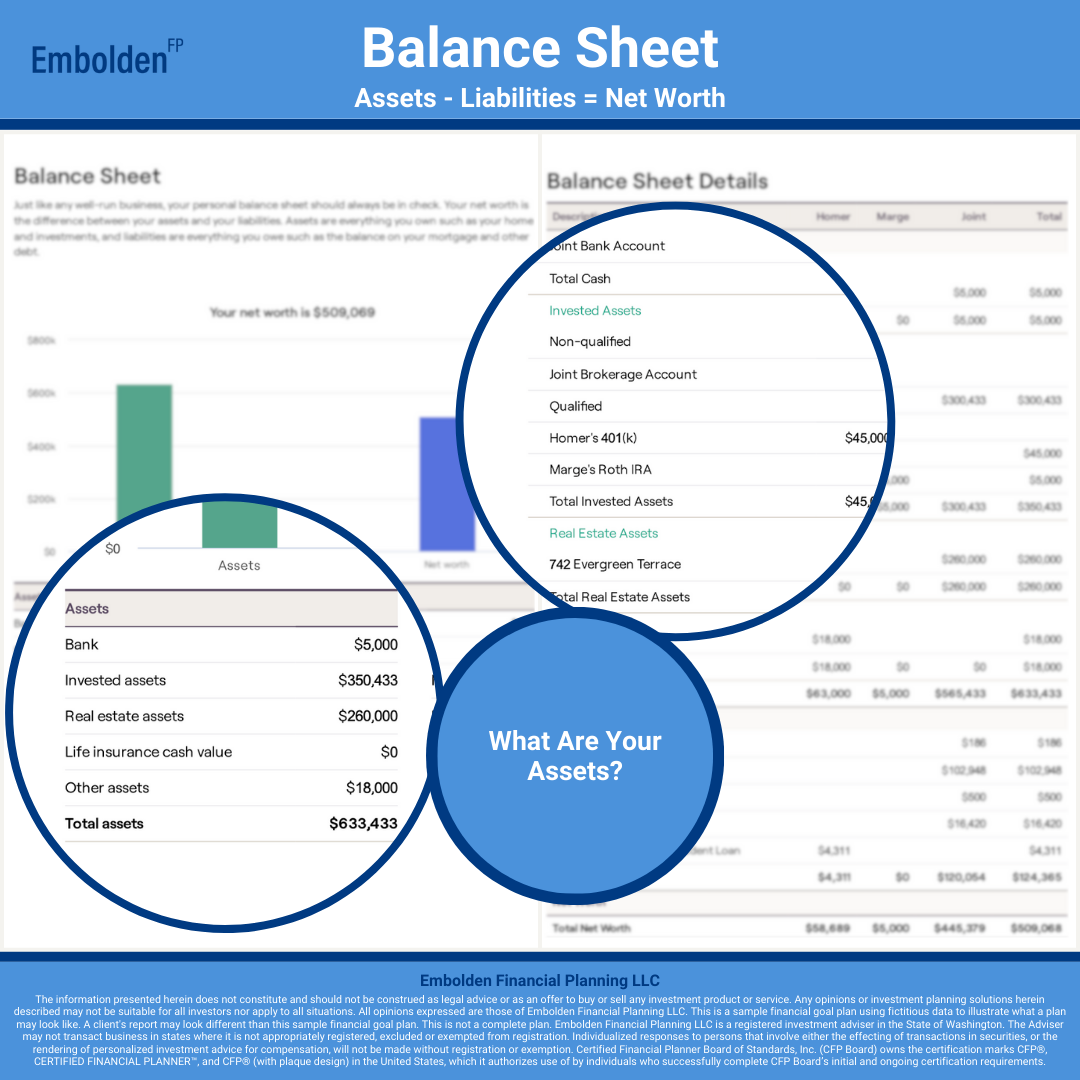

Here is Homer and Marge’s Balance Sheet with all the details.

It shows their assets, liabilities, and net worth together in one clear view.

-

![Balance Sheet Assets Financial Goal Plan]()

Homer and Marge can see a full view of their assets.

These include bank accounts, investment accounts, their home, and their car.

-

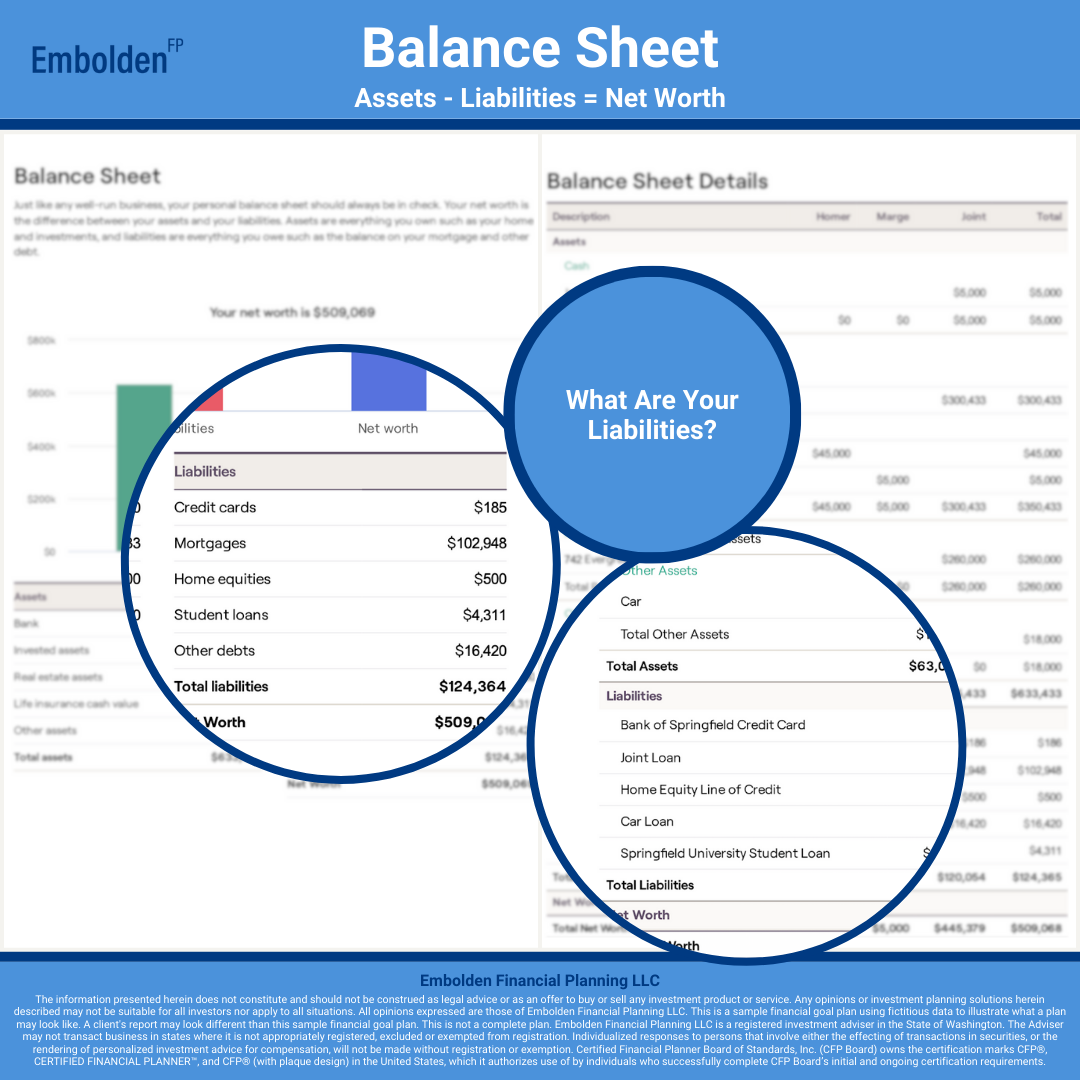

![Balance Sheet Liabilities Financial Goal Plan]()

Homer and Marge can also see their liabilities.

These include a credit card balance, a mortgage, a home equity line of credit, a car loan, and a student loan.

-

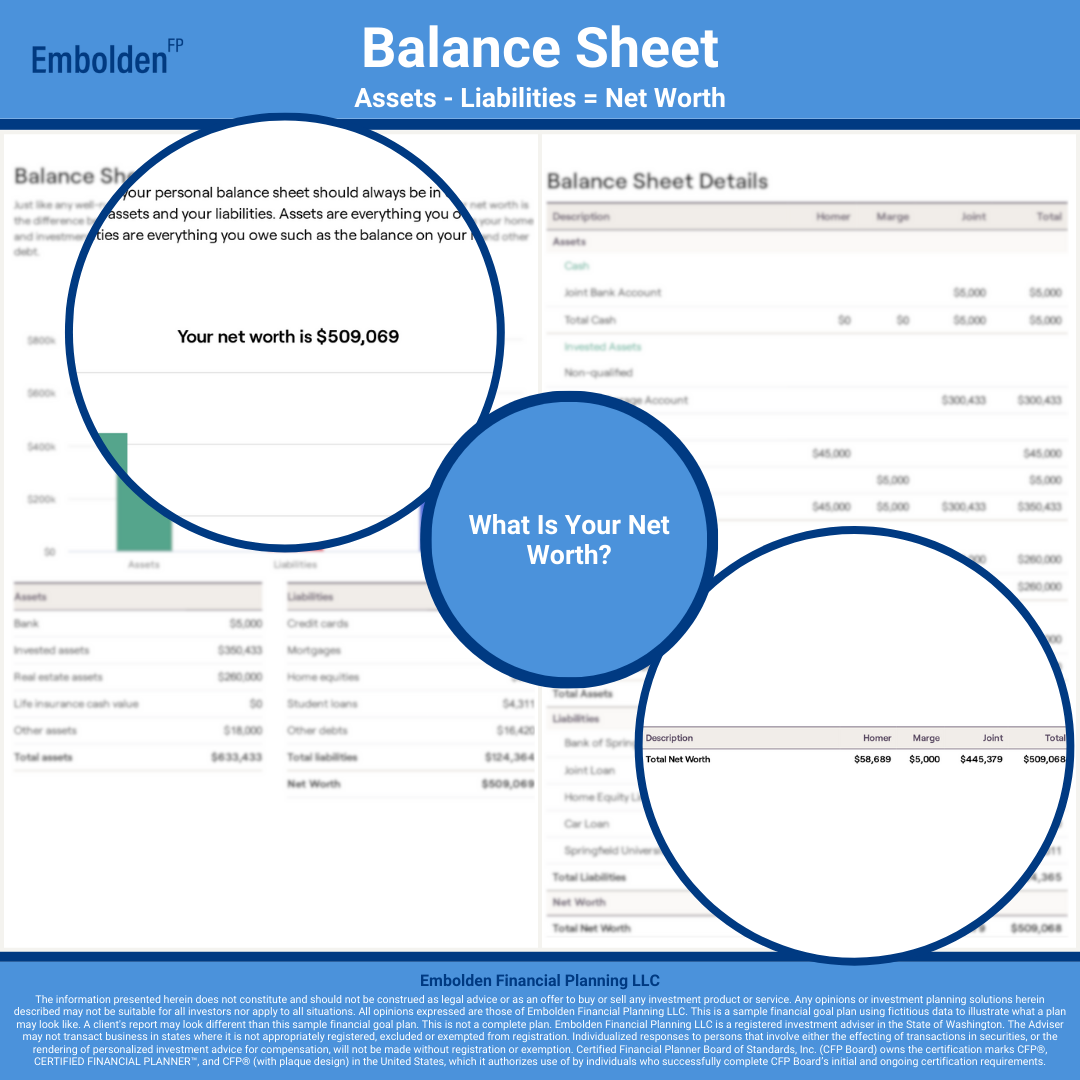

![Balance Sheet Net Worth Financial Goal Plan]()

Now Homer and Marge can see their net worth.

The difference between their assets and liabilities.

-

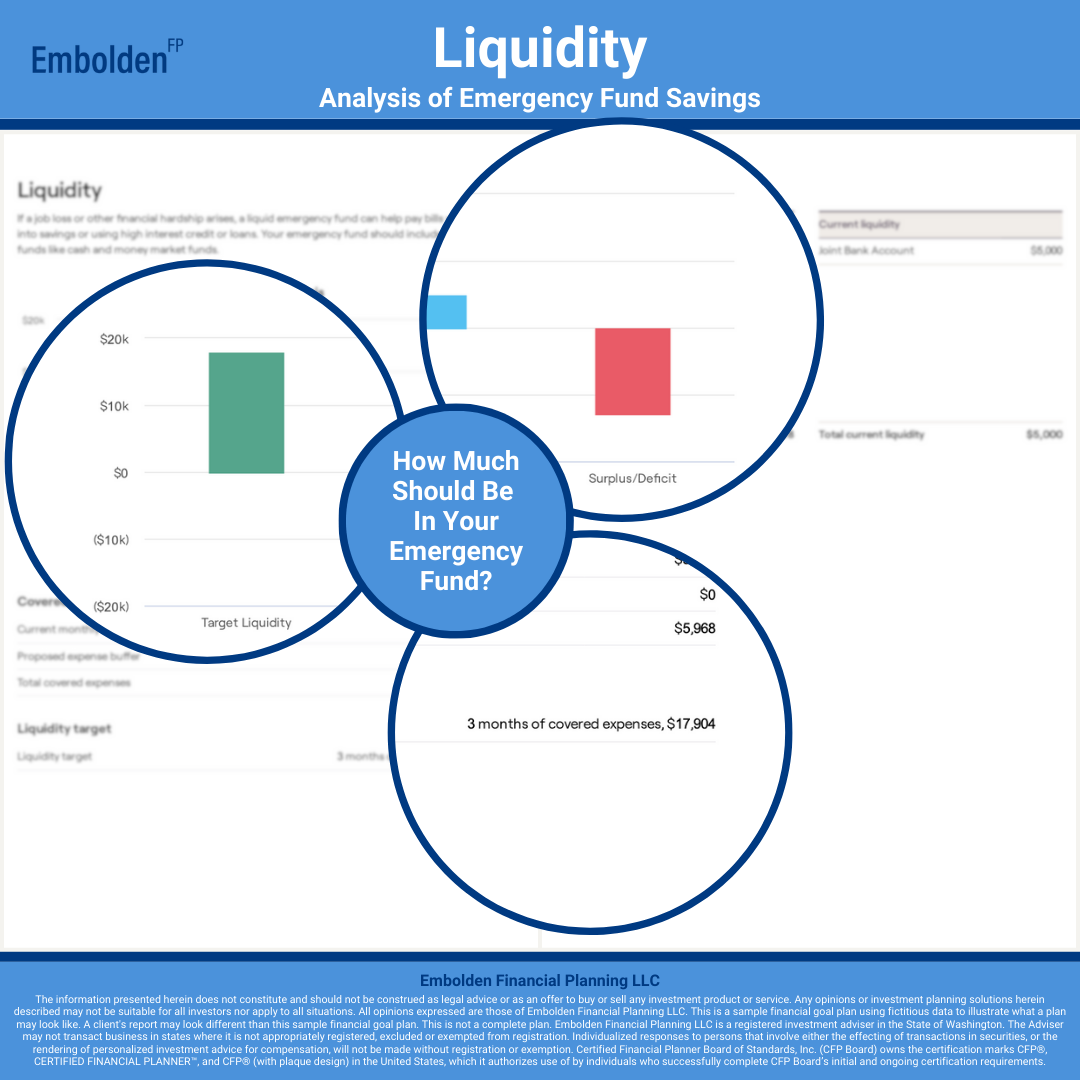

![Liquidity Summary Financial Goal Plan]()

Homer and Marge have set up an emergency fund.

After discussing with Embolden Financial Planning LLC, they decided to keep three months of living expenses in liquid savings. This fund is reserved for true emergencies, such as unexpected medical bills, home repairs, or job loss.

-

![Liquidity Current Financial Goal Plan]()

This is Homer and Marge’s emergency fund.

Right now, it’s kept in the same bank account they use for everyday expenses.

-

![Liquidity Target Financial Goal Plan]()

This is how much Homer and Marge want in their emergency fund.

To reach their target, they’ll need to set aside some additional cash. One idea is to open a separate bank account and label it “Emergency Fund” to keep the purpose clear.

-

![Budget Summary Financial Goal Plan]()

Homer and Marge now have a budget.

At first, they weren’t sure where their money was going. After securely linking their accounts in RightCapital, their transactions were reviewed and organized. They created a budget that fits their goals.

-

![Budget Actual Financial Goal Plan]()

Now Homer and Marge know where their money is going.

Their expenses are grouped into categories such as housing, utilities, groceries, and loan payments, making it easier to see the full picture of their spending.

-

![Budget Target Financial Goal Plan]()

Now Homer and Marge know what they want their spending to look like.

Having a clear budget helps them stay on track and make steady progress toward their financial goals.

-

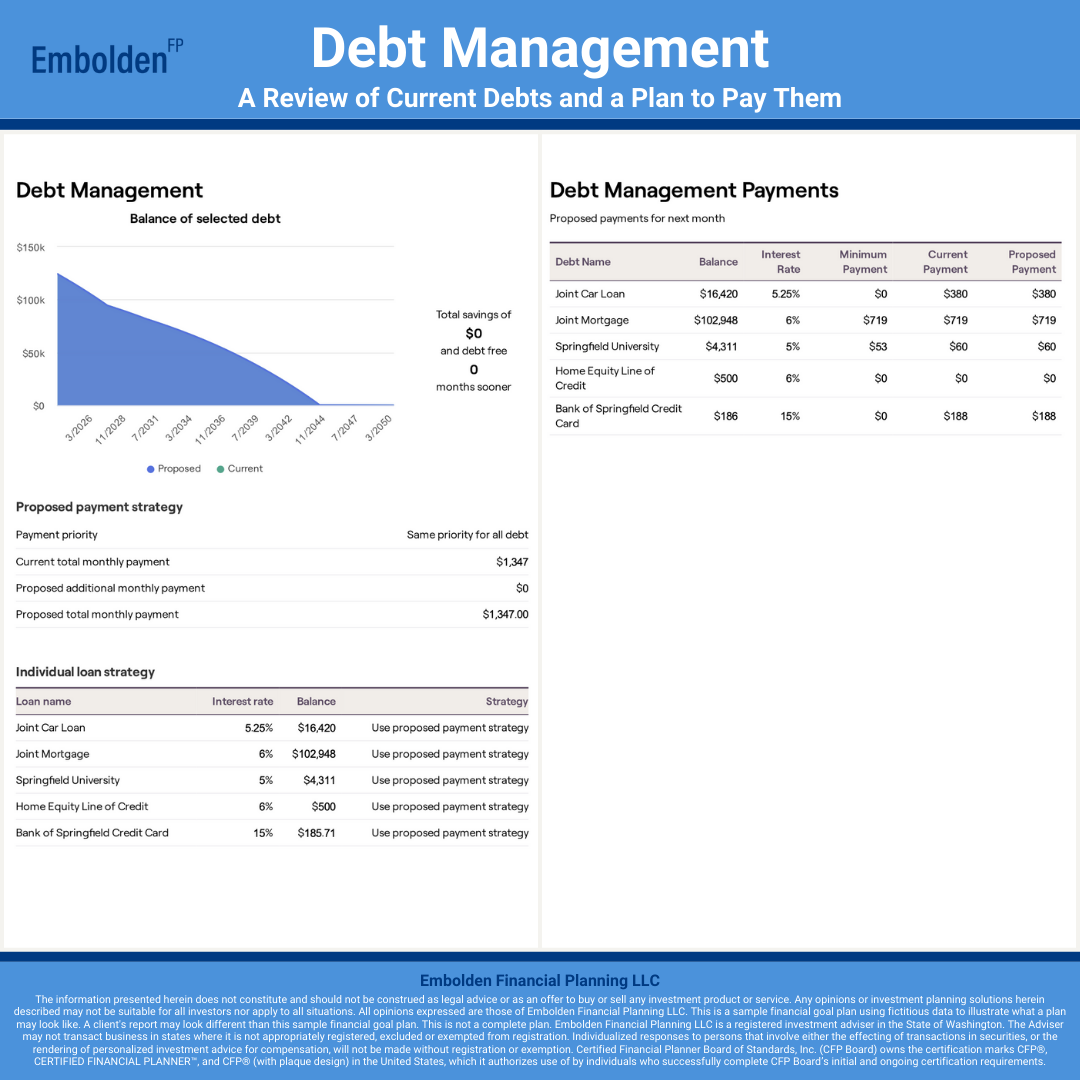

![Debt Management Summary Financial Goal Plan]()

Homer and Marge have some debt.

After sharing the details with Embolden Financial Planning LLC and exploring repayment strategies, they now have a clear plan in place to manage it with confidence.

-

![Debt Management Current Financial Goal Plan]()

Homer and Marge now have a clear picture of their debts.

They can easily see who they owe, the balances, and the interest rates for each loan.

-

![Debt Management Target Financial Goal Plan]()

Now Homer and Marge have a debt repayment strategy.

After reviewing their options, they decided to continue with their current payment schedule, which keeps them on track.

-

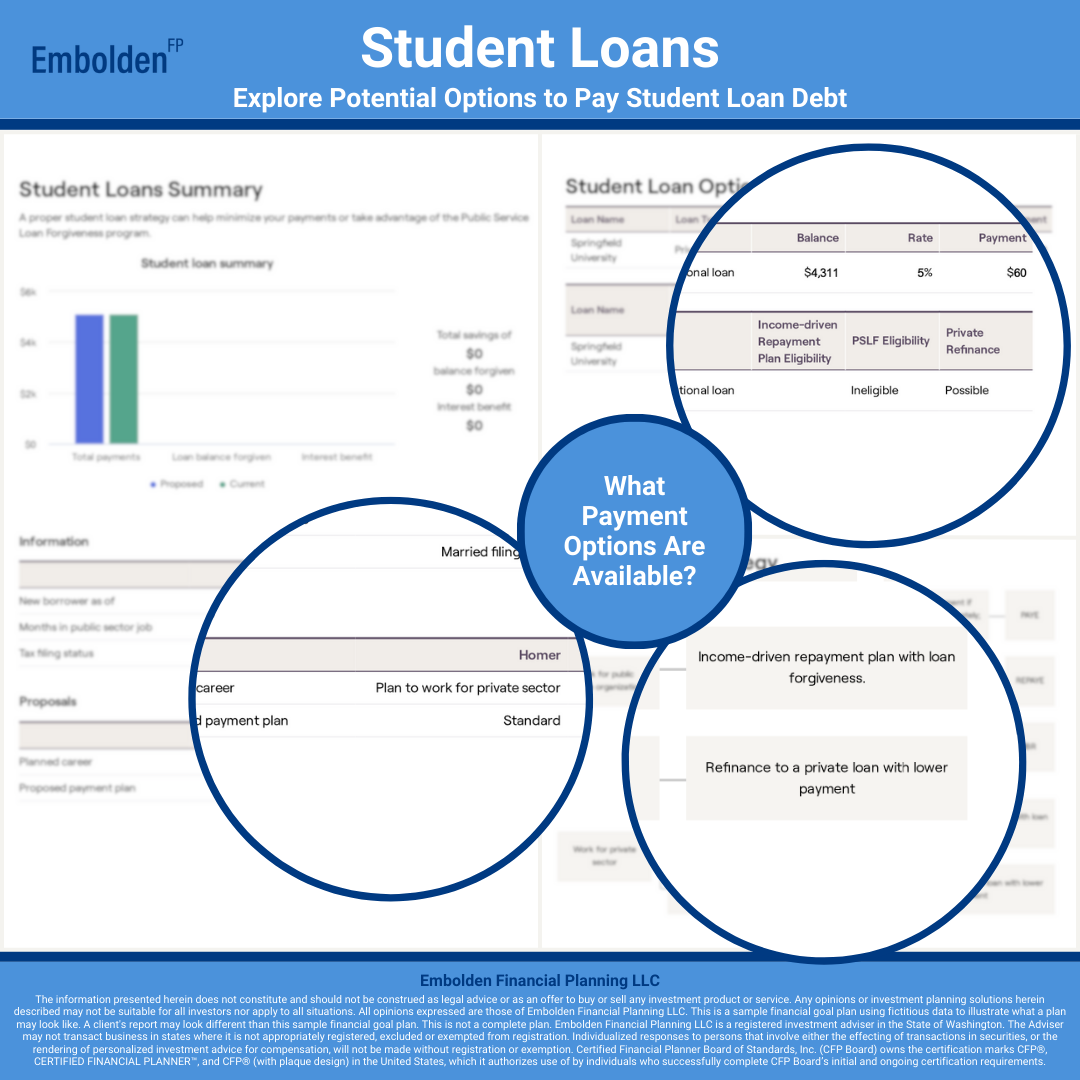

![Student Loans Current Financial Goal Plan]()

Homer has some student loan debt.

Because student loans come with unique repayment options and, in some cases, forgiveness, Embolden Financial Planning analyzed his situation to see if any of these programs could help reduce or manage his payments.

-

![Student Loans Payment Options Financial Goal Plan]()

Homer doesn’t have many student loan repayment options.

Because he works in the private sector, he isn’t eligible for the programs available to public service employees. However, he may still qualify for an income-driven repayment plan, which could help manage his monthly payments.

-

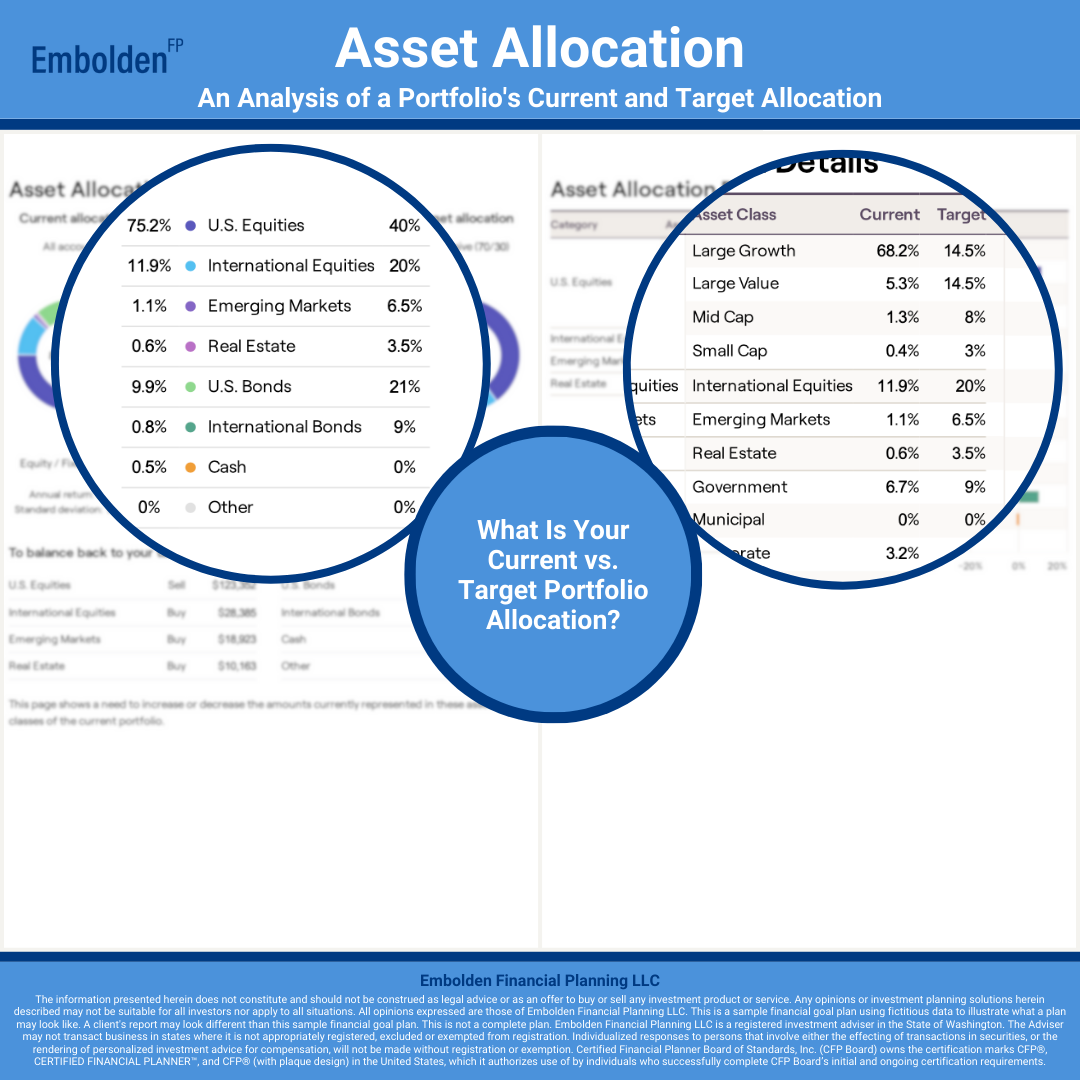

![Asset Allocation Summary Financial Goal Plan]()

Homer and Marge have set a target asset allocation.

After completing risk tolerance questionnaires, they discussed with Embolden Financial Planning LLC how much investment risk felt appropriate, what level would let them sleep soundly at night, and how it fit into their financial goal plan. Together, they decided to reduce portfolio risk by lowering their allocation to equities and increasing their allocation to fixed income.

-

![Asset Allocation Current vs Target Financial Goal Plan]()

Homer and Marge can see how their current allocation lines up with their target allocation.

Embolden Financial Planning LLC will provide specific trade recommendations to align Homer and Marge’s portfolio with their target in a tax-efficient way. At their Review Meeting, they’ll receive updated recommendations to keep the portfolio on track.

-

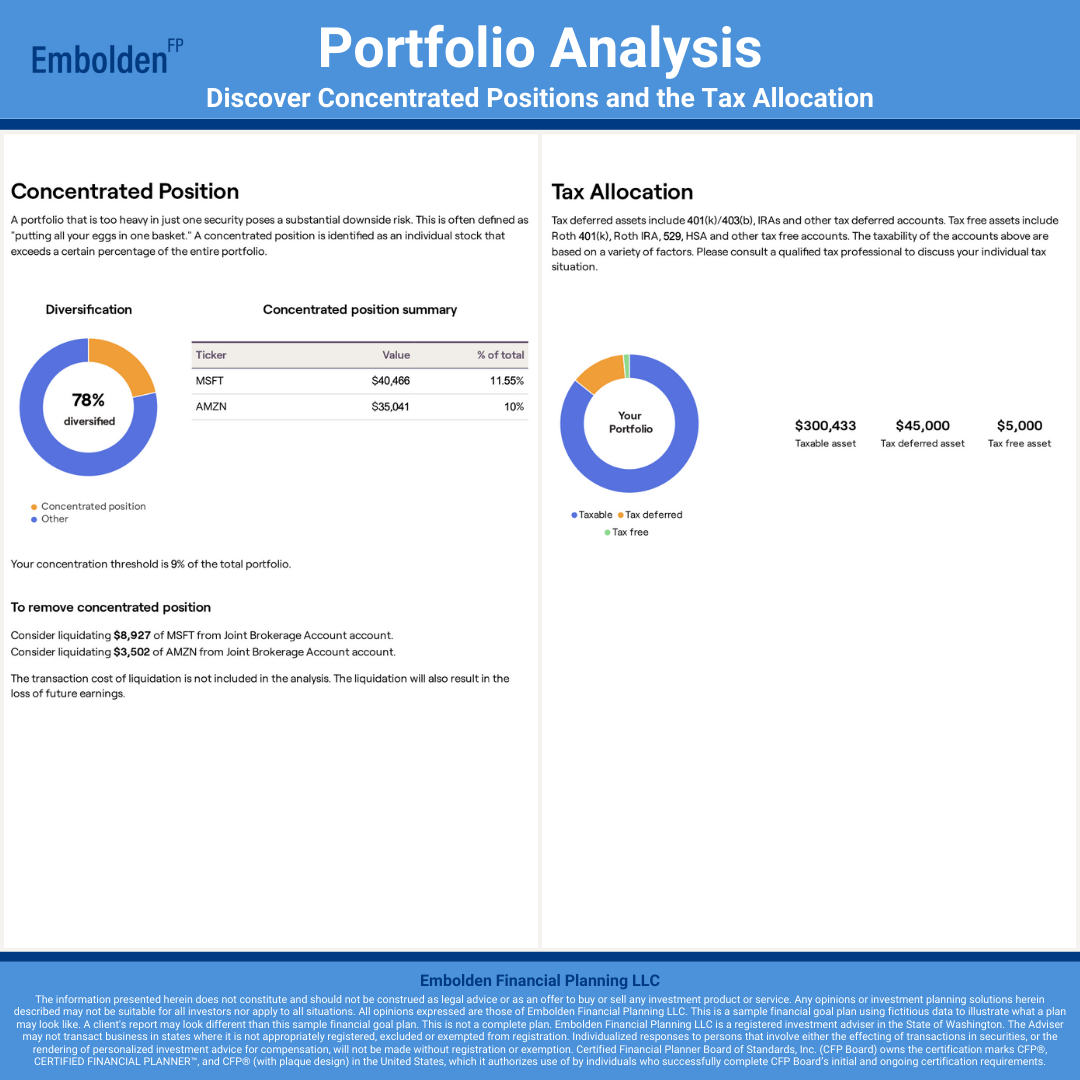

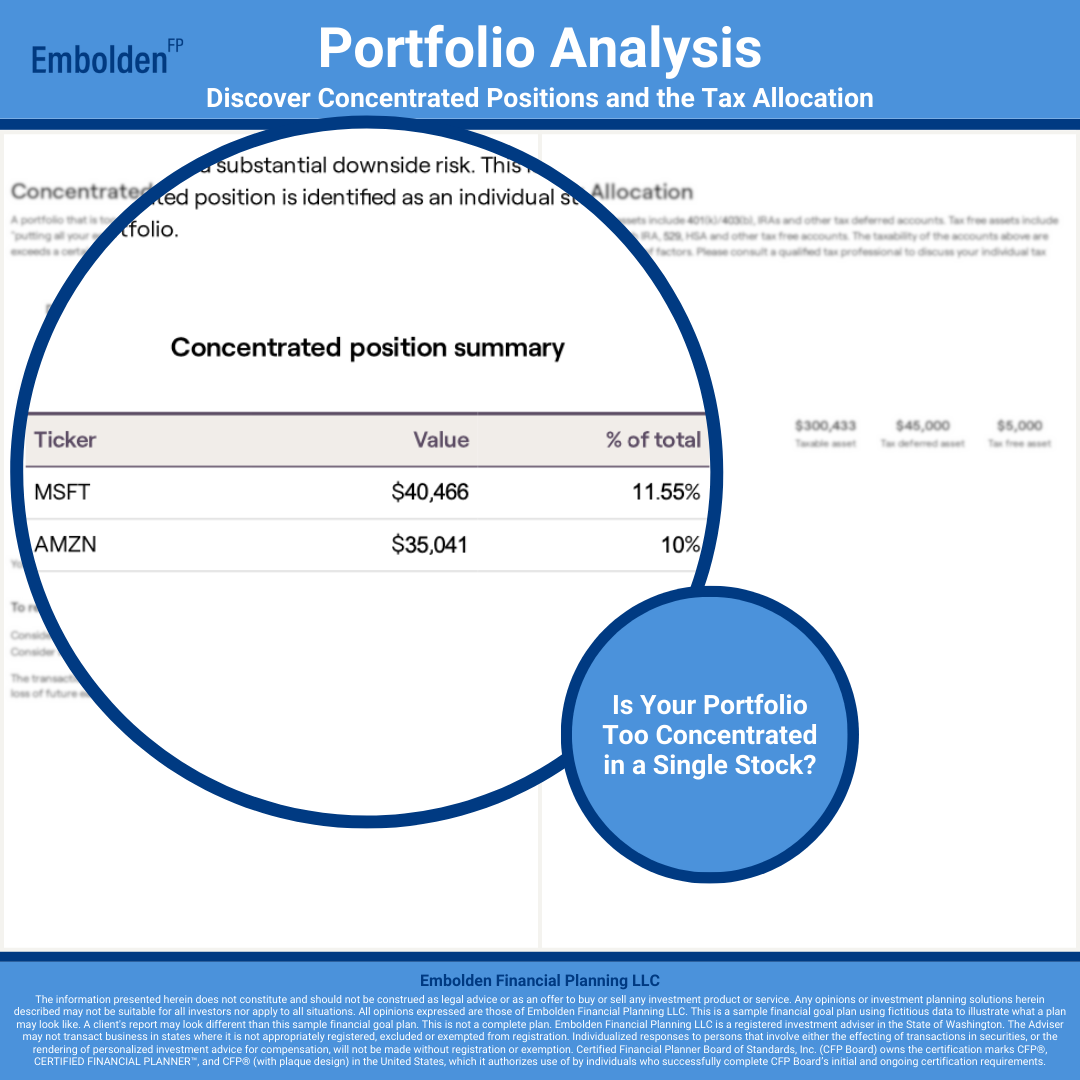

![Portfolio Analysis Summary Financial Goal Plan]()

Homer and Marge have concentrated positions.

Amazon and Microsoft have grown into a large part of their current investment portfolio, and much of their money is held in taxable accounts.

-

![Portfolio Analysis Concentrated Position Financial Goal Plan]()

Homer and Marge want a strategy to reduce their concentrated positions.

After working with Embolden Financial Planning LLC, they now have a plan to sell portions of their shares over several years, spreading the tax impact across multiple tax years.

-

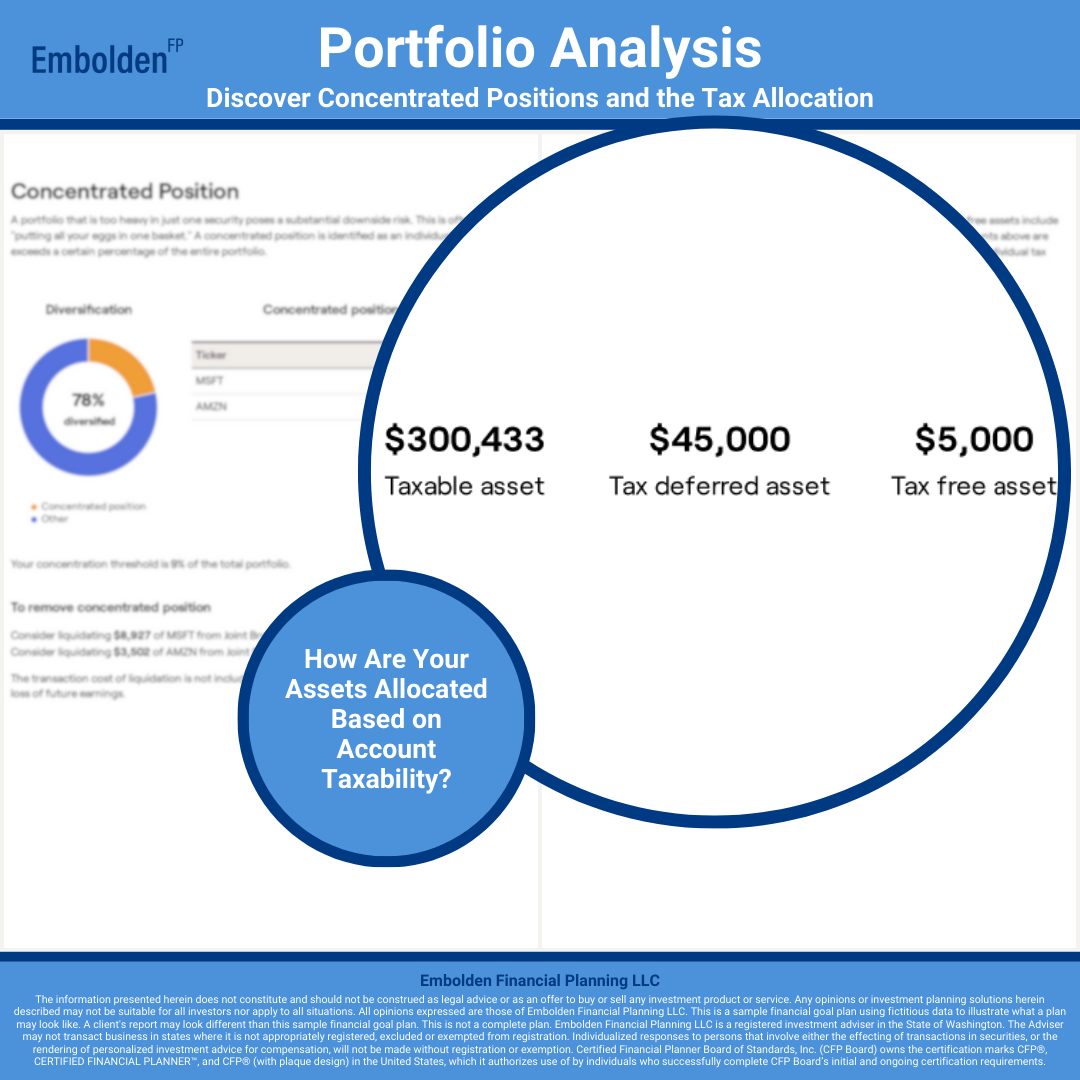

![Portfolio Analysis Tax Allocation Financial Goal Plan]()

Homer and Marge now see how their accounts are allocated based on taxability.

This helps them understand which assets are in taxable, tax-deferred, and tax-free accounts.

-

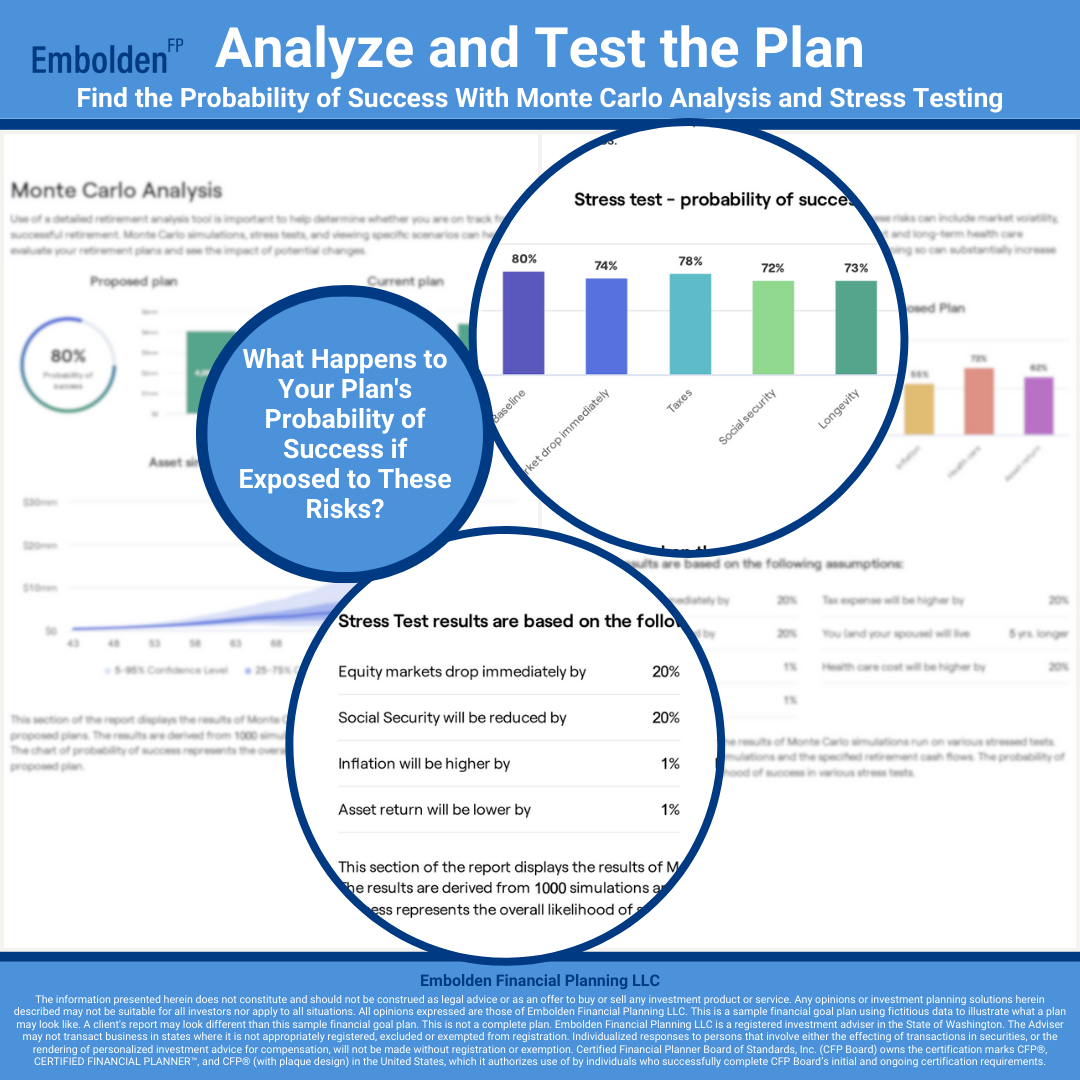

![Analyze Test Summary Financial Goal Plan]()

Homer and Marge’s financial goal plan has been analyzed and tested.

It was run through 1,000 Monte Carlo simulations and stress-tested to see how different risks could affect their plan.

-

![Analyze Test Monte Carlo Financial Goal Plan]()

The probability of success for Homer and Marge’s plan is 80%.

There is an 80% chance they will not run out of money in any year of their plan.

-

![Analyze Test Stress Financial Goal Plan]()

Different risks can reduce the probability of success.

For example, a 20% cut in Social Security, higher-than-expected inflation, or lower investment returns could lower the probability by up to 8%.

-

![Savings Retirement Summary Financial Goal Plan]()

Homer and Marge have a savings plan and a retirement spending plan.

They can see how much they are projected to save each year until retirement, and once retired, they can see their projected income and expenses for every year of their plan.

-

![Savings Retirement Now Future Financial Goal Plan]()

This is how Homer and Marge plan to save for their future goals.

Most of their savings are projected to go toward retirement, but they are also setting money aside for their children’s future education.

-

![Savings Retirement Income Spending Financial Goal Plan]()

When Homer and Marge retire, this is how they will fund their lifestyle.

Most of their retirement expenses will be covered by their savings and Social Security benefits.

-

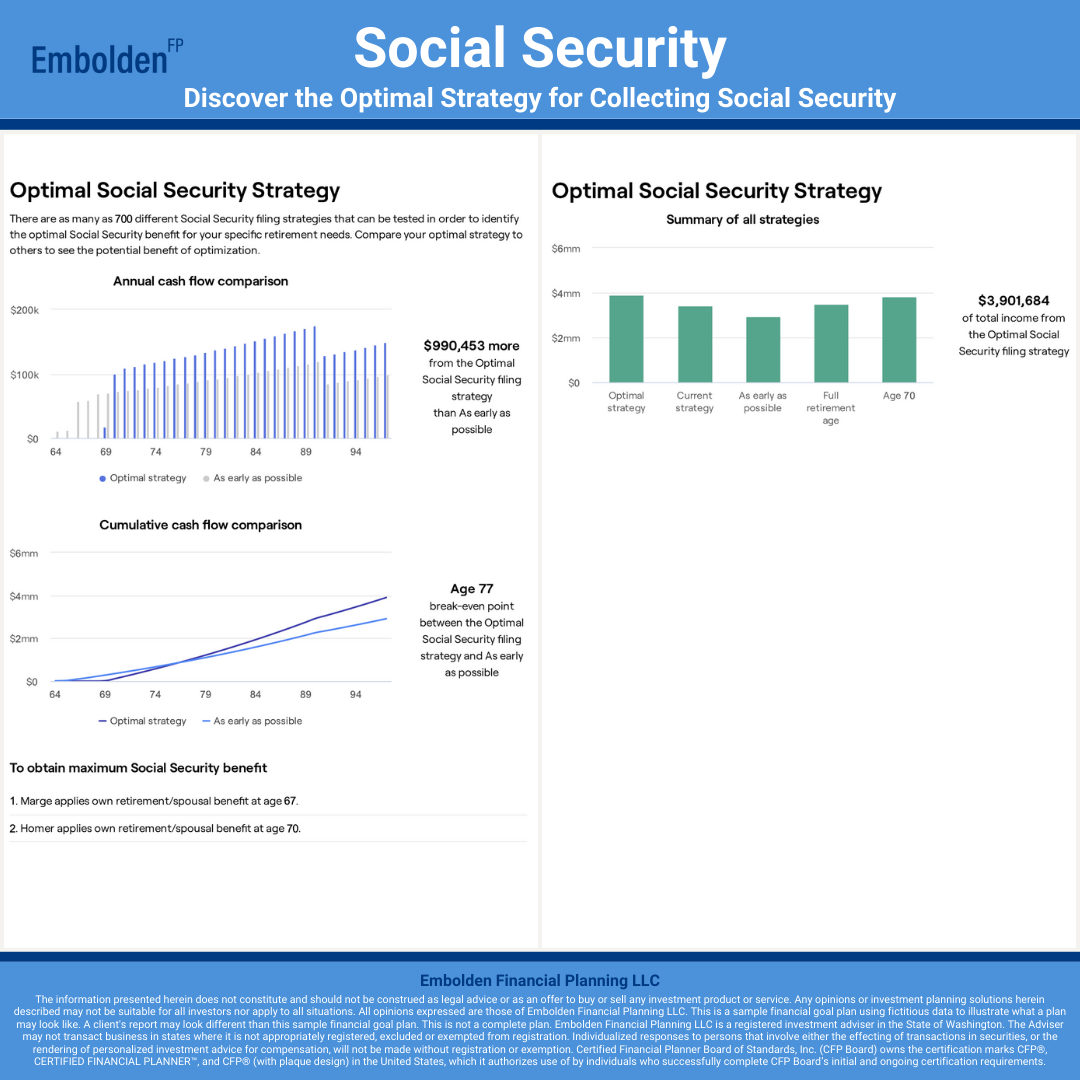

![Social Security Summary Financial Goal Plan]()

Homer and Marge want to maximize their Social Security benefits.

After reviewing their statements, Embolden Financial Planning LLC presented the optimal strategy for when and how to collect.

-

![Social Security Start Collecting Financial Goal Plan]()

It makes the most sense for Homer and Marge to file for Social Security at different ages.

By following the optimal strategy, their plan projects a significantly higher total benefit over time.

-

![Social Security Optimal Strategy Financial Goal Plan]()

Homer and Marge have a break-even age.

By delaying Social Security benefits, the analysis shows they are projected to come out ahead over time.

-

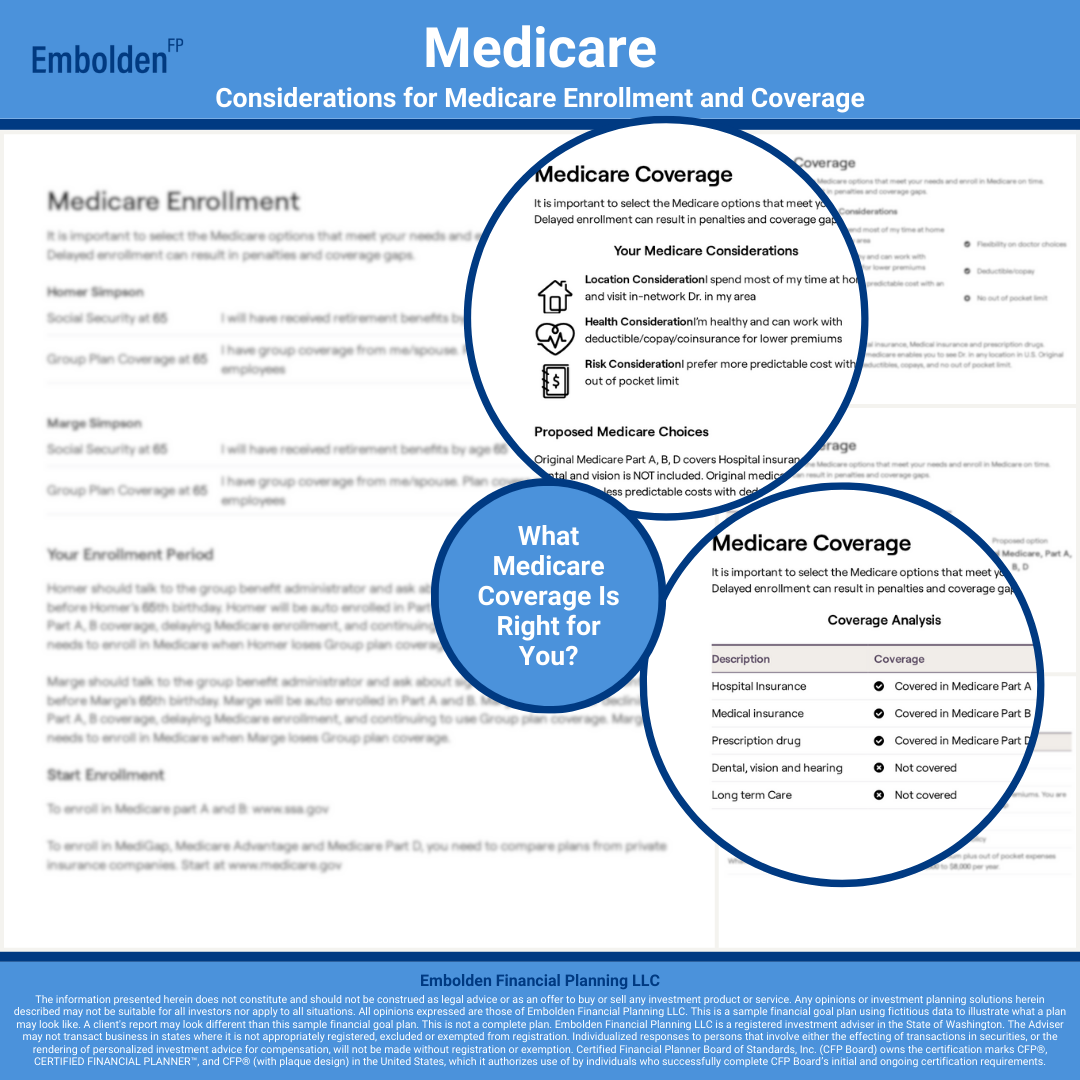

![Medicare Summary Financial Goal Plan]()

Homer and Marge aren’t focused on Medicare yet.

But now they understand what may affect their future decisions and have a resource to guide them when the time comes.

-

![Medicare Enrollment Coverage Tips Financial Goal Plan]()

Homer and Marge’s Medicare coverage will depend on several factors.

These include whether they have employer coverage, where they live in retirement, and their health status. They plan to discuss their options with Embolden Financial Planning LLC when it’s time to decide.

-

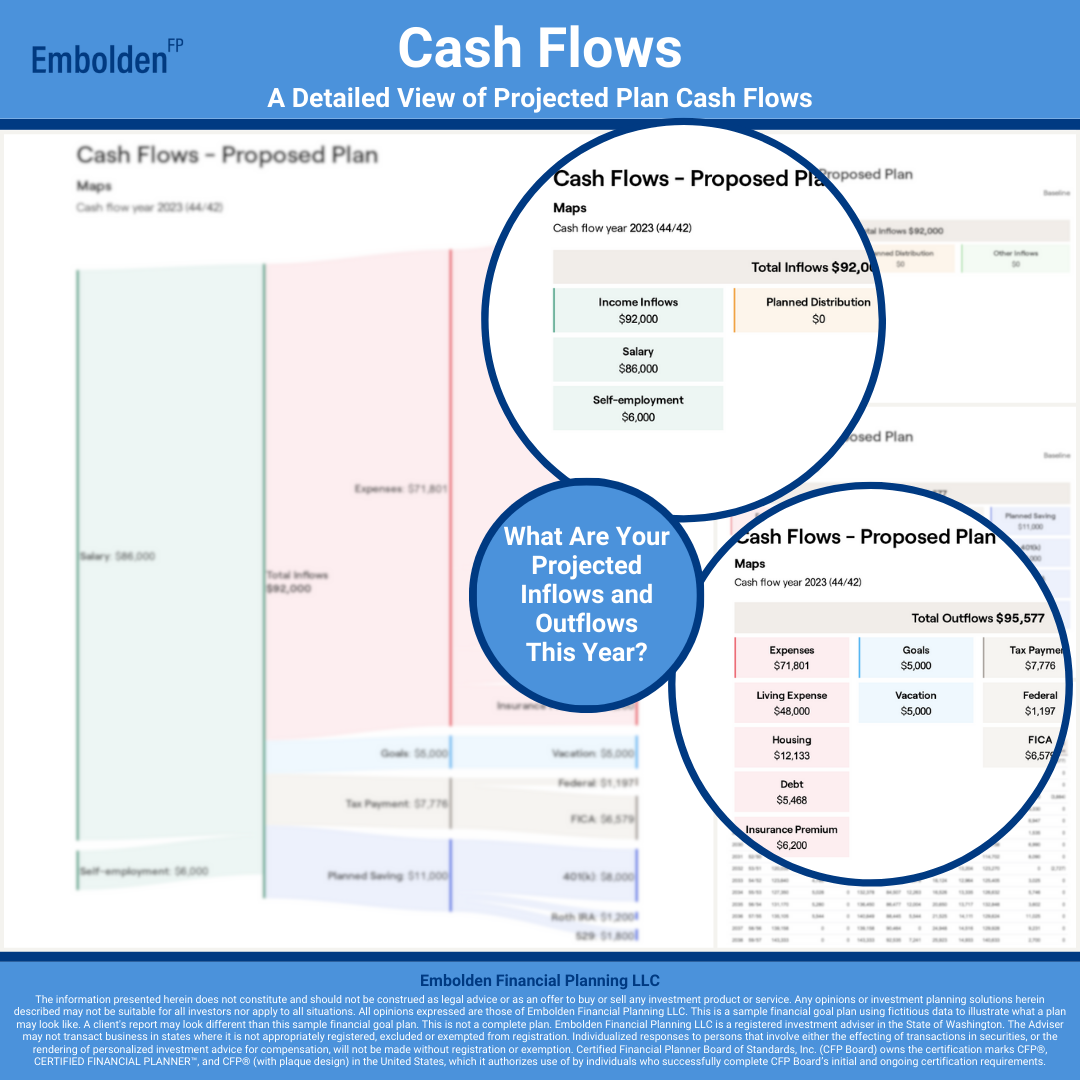

![Cash Flow Summary Financial Goal Plan]()

Homer and Marge like the different ways of viewing their cash flows..

The colorful waterfall chart and other visuals give one view of their cash flows, while a detailed line-by-line report shows the numbers in more depth.

-

![Cash Flow Current Projection Financial Goal Plan]()

Homer and Marge are projected to spend a little more than they earn this year.

Now they can clearly see where the money is going and where adjustments could be made.

-

![Cash Flow Annual Financial Goal Plan]()

It looks like Homer and Marge will be back on track next year.

They are projected to have cash in excess of their planned savings available to spend.

-

![Life Insurance Summary Financial Goal Plan]()

Homer has life insurance, but they wondered if it was enough.

Embolden Financial Planning LLC reviewed his coverage and how it would support his surviving spouse, Marge, through the end of their financial goal plan.

-

![Life Insurance How Much Financial Goal Plan]()

It looks like Homer and Marge have sufficient life insurance coverage for their needs.

In fact, Homer has more coverage than he is projected to need. Homer and Marge are comfortable keeping more insurance than required, so no action is needed. Working with Embolden Financial Planning LLC, a fiduciary financial planner that does not sell products or earn commissions, gives them confidence that all recommendations are in their best interest.

-

![Disability Insurance Summary Financial Goal Plan]()

Homer has disability insurance, but they weren’t sure if it was enough.

Embolden Financial Planning LLC reviewed his coverage and how it would support them and the success of their financial goal plan.

-

![Disability Insurance How Much Financial Goal Plan]()

It looks like Homer and Marge have sufficient disability insurance coverage for their needs.

Homer’s employer policy is projected to cover 49% of his income if he is unable to work due to a disability. After discussing with Embolden Financial Planning LLC, they decided no additional coverage is needed.

-

![Long-Term Care Insurance Summary Financial Goal Plan]()

Homer and Marge each have long-term care insurance policies.

After seeing how costly and important care was for their aging parents, they worked with an insurance broker to obtain coverage of their own.

-

![Long-Term Care Insurance How Much Financial Goal Plan]()

Homer and Marge have sufficient long-term care insurance coverage.

After reviewing their plan, which included higher living expenses in later years related to aging and diminished mobility, it was determined they could self-insure for any costs not covered by their policies.

-

![Property Casualty Insurance Summary Financial Goal Plan]()

Homer and Marge have property and casualty insurance in place.

This includes homeowner’s insurance to protect their home, auto insurance for injuries and property damage, and umbrella insurance for additional liability coverage.

-

![Property Casualty Insurance How Much Financial Goal Plan]()

Homer and Marge do need to make an adjustment to their coverage.

After discussing with Embolden Financial Planning LLC, it was determined they should increase their homeowner’s coverage to 80% of their home value. They already meet the state minimum requirements for auto insurance, so no changes are needed there. After reviewing their plan and current liability coverage, Embolden believes umbrella insurance is not necessary at this time.

-

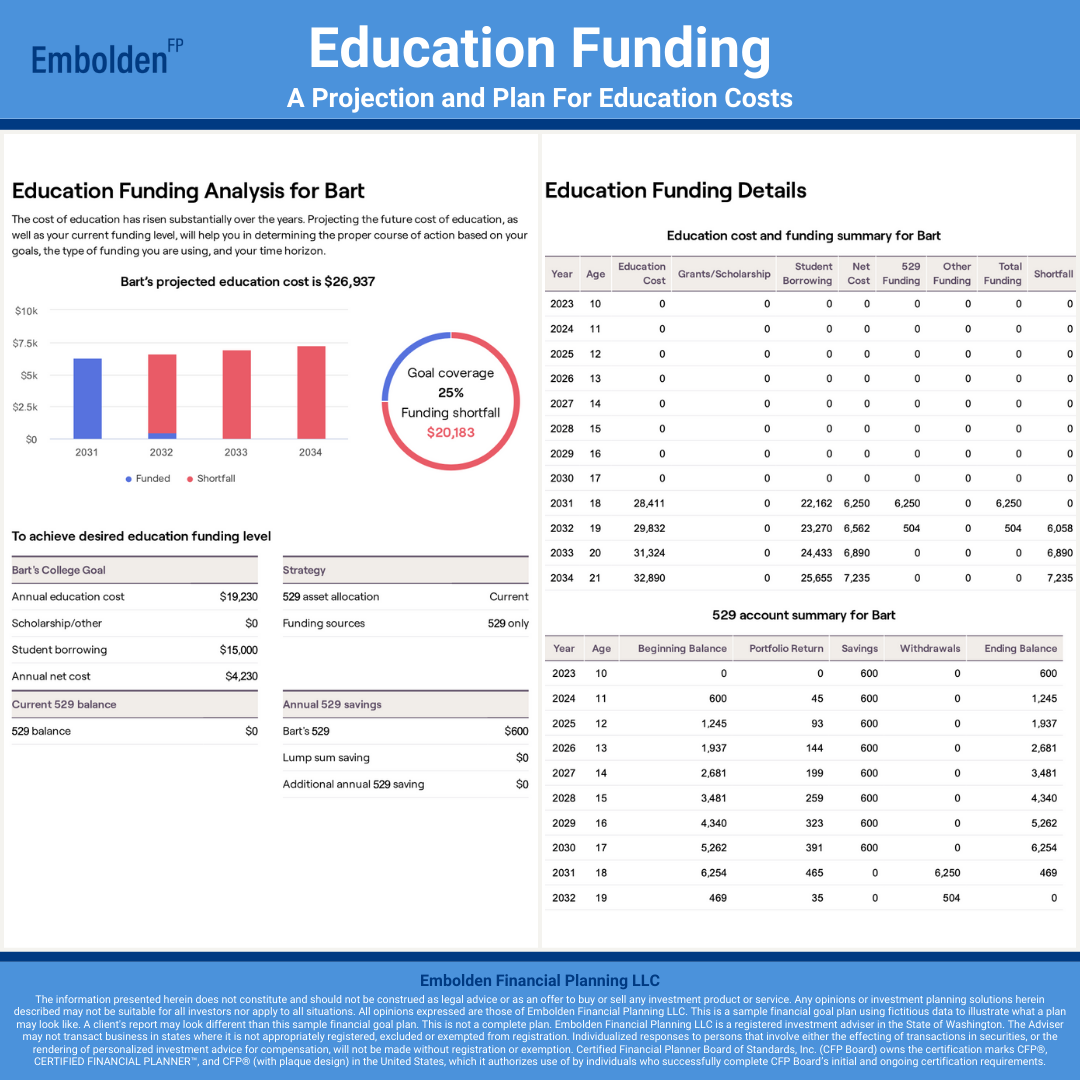

![Education Funding Summary Financial Goal Plan]()

Homer and Marge are planning for all three of their children to attend college.

They wanted to understand how much to save for each child and how those savings would affect their overall financial goal plan.

-

![Education Funding Cost Financial Goal Plan]()

This is the education funding analysis for their oldest son, Bart.

Based on projected college costs, scholarships, and student borrowing, Homer and Marge have set a target savings amount to help him through school. They opened a 529 College Savings Plan and will make annual contributions. Embolden Financial Planning LLC completed this same analysis for each of their three children.

-

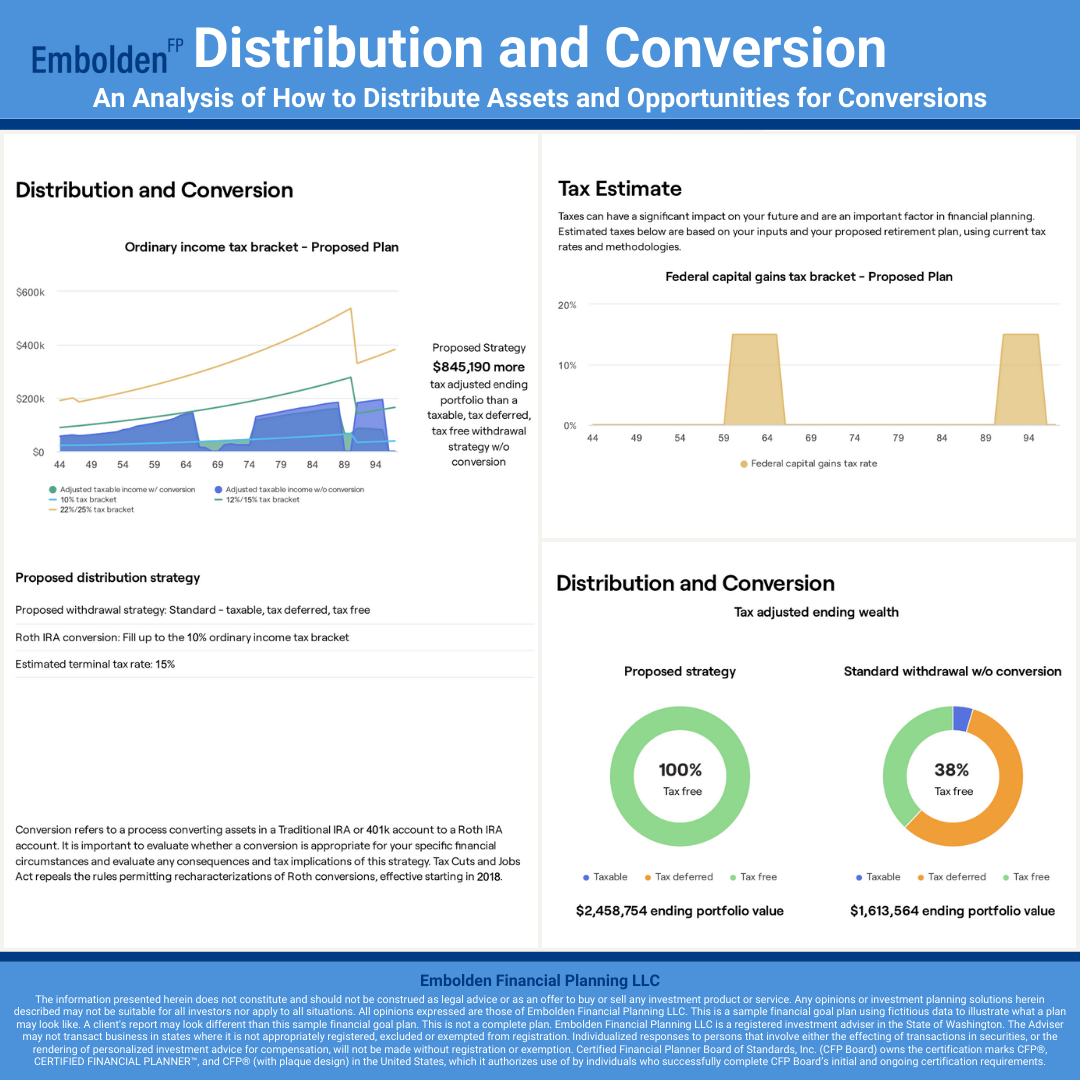

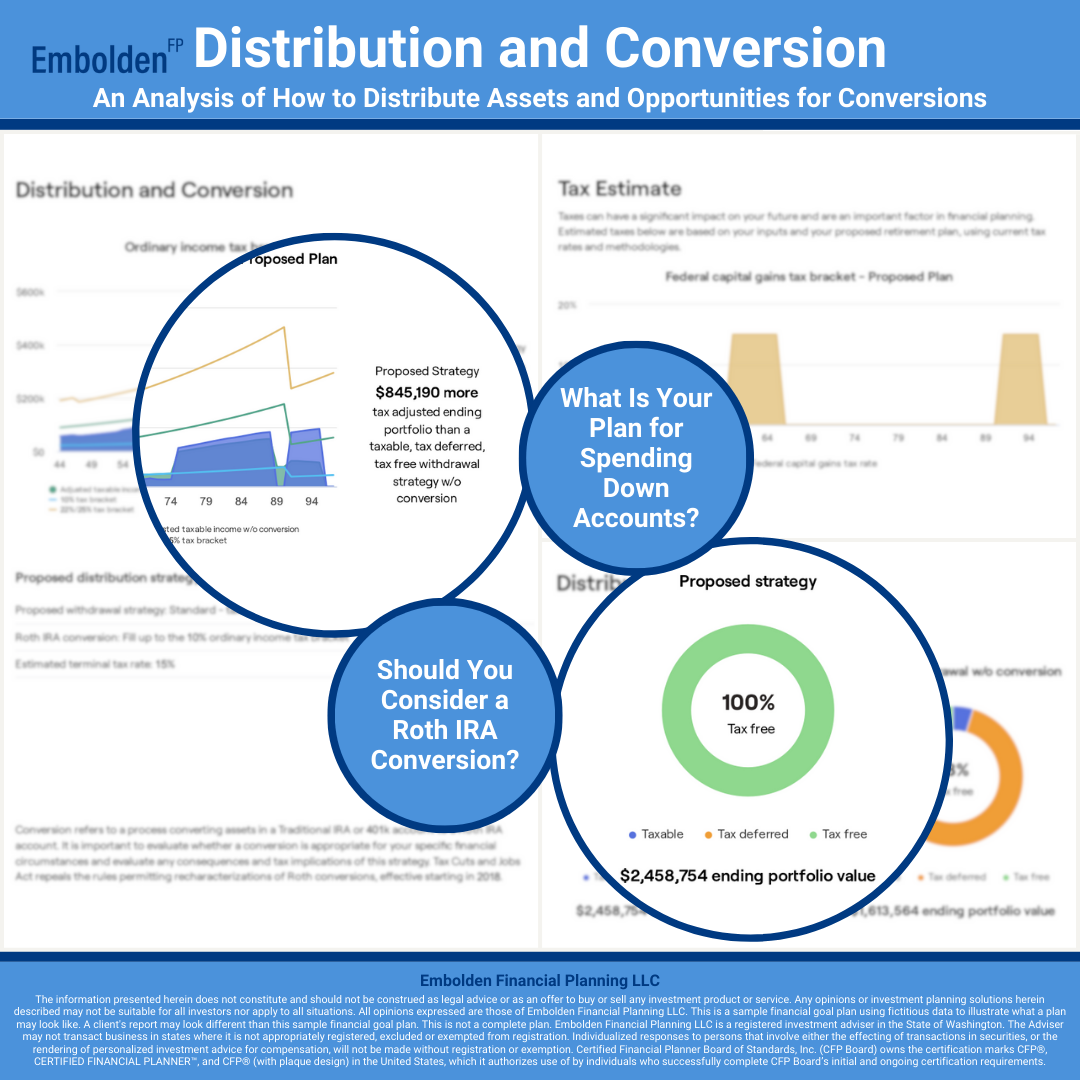

![Distribution Conversion Summary Financial Goal Plan]()

Homer and Marge have a plan for Roth IRA conversions.

Embolden Financial Planning LLC analyzed their projected income, timing, and tax brackets to identify the best opportunities to convert.

-

![Distribution Conversion Spending Roth IRA Financial Goal Plan]()

Roth IRA conversions may significantly increase Homer and Marge’s portfolio value.

By converting tax-deferred accounts into tax-free accounts at the right time, they are projected to grow their portfolio more effectively.

-

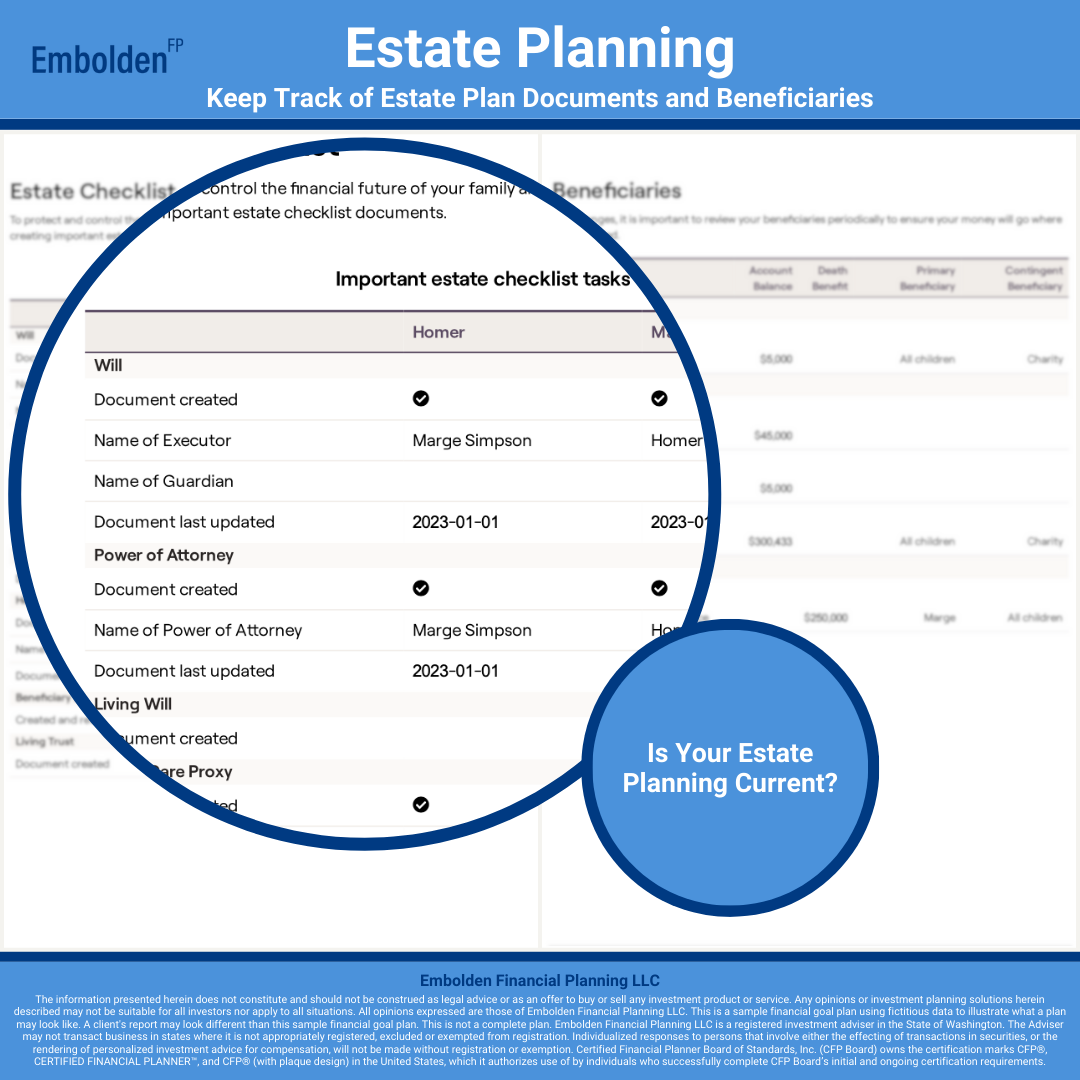

![Estate Planning Checklist Beneficiary Summary Financial Goal Plan]()

Homer and Marge have an estate plan in place.

Embolden Financial Planning LLC reviewed the documents they created with an estate planning attorney and prepared a report to help keep everything organized. A review of their account beneficiaries was also completed.

-

![Estate Planning Checklist Beneficiary Current Financial Goal Plan]()

Everything in Homer and Marge’s estate plan looks complete and up to date.

At their annual review with Embolden Financial Planning LLC, this may be one of the topics they revisit to ensure the plan remains appropriate.

-

![Estate Planning Checklist Beneficiary Review Financial Goal Plan]()

All of Homer and Marge’s accounts have the correct beneficiaries.

If any were missing or outdated, Embolden Financial Planning LLC would recommend updating them to keep everything current.

-

![Estate Planning Illustration Summary Financial Goal Plan]()

Here is an illustration of Homer and Marge’s estate plan.

It shows how their assets are projected to flow, and to whom, at the end of their lives based on their actual estate plan and projected asset values.

-

![Estate Planning Illustration What Happens Financial Goal Plan]()

It is helpful for Homer and Marge to see where their assets are going.

This illustration showed that none of their estate was directed to charitable causes, even though they would like to give more. They have scheduled a meeting with Embolden Financial Planning LLC to discuss charitable giving strategies.

-

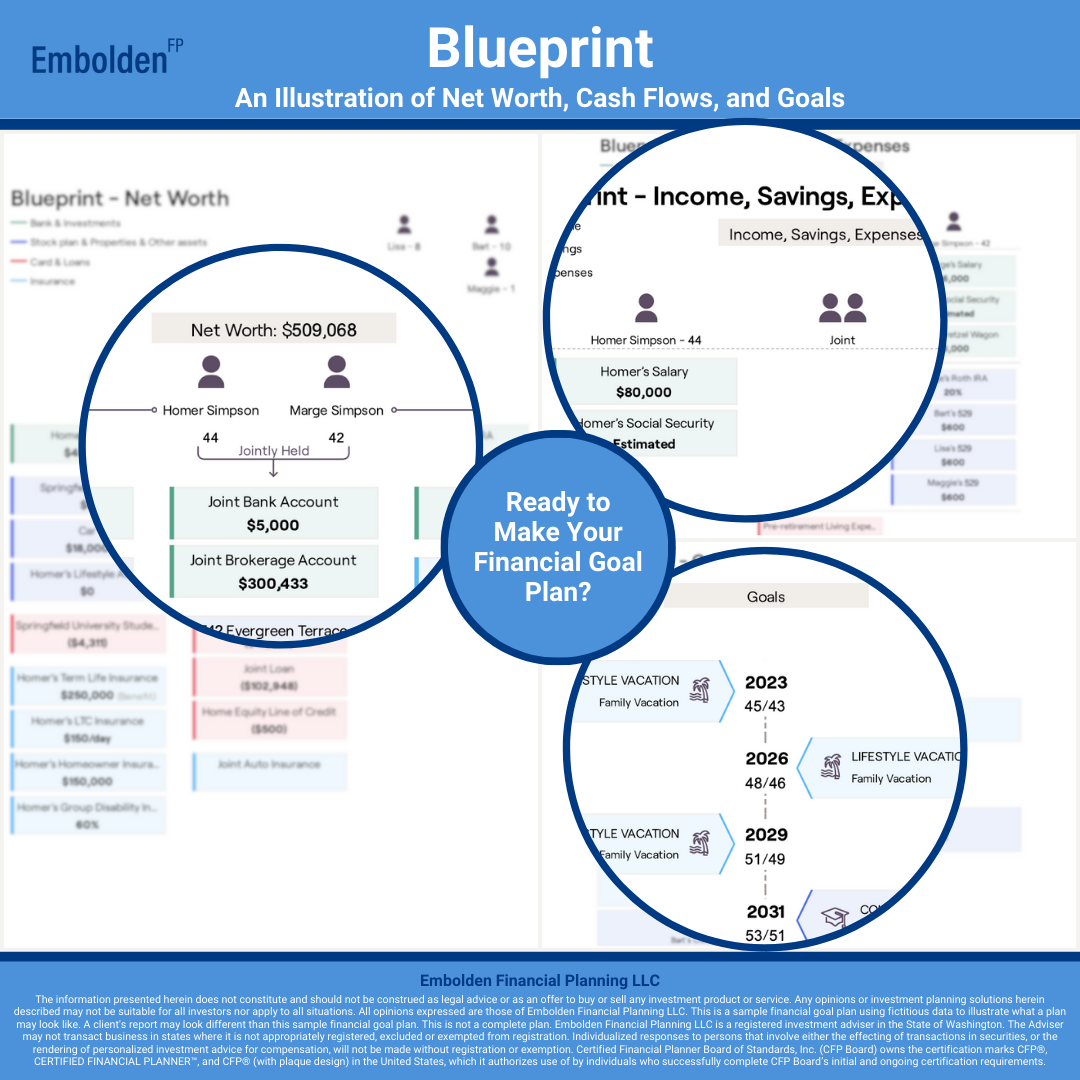

![Blueprint Summary Financial Goal Plan]()

This is the blueprint for Homer and Marge’s financial goal plan.

It illustrates their net worth, income, savings, expenses, and goals all in one place.

-

![Blueprint Ready to Make Financial Goal Plan]()

Homer and Marge are now clear on their plan for the future.

Along with this report, they received detailed instructions for implementation, including specific trades to align their portfolio with their target allocation. If questions come up, they know Embolden Financial Planning LLC is available to help by email or in a meeting.

-

![Blueprint Ready to Make Financial Goal Plan]()

Homer and Marge are now confident about their plan for the future.

They know this is just the beginning of their relationship with Embolden Financial Planning LLC. They plan to meet annually to review their portfolio, confirm it stays aligned with their target asset allocation, and update their financial goal plan as their lives and goals evolve.

-

![A financial planning infographic titled 'Blueprint' with sections on net worth, income, savings, expenses, and goals.]()

Seeking clarity and confidence in your financial life?

Ready to make your own financial goal plan?